摘要:,,本文介绍了支付海关关税的过程,包括理解和应对海关关税支付的方式和步骤。文章强调了了解海关规定和程序的重要性,并解释了如何正确计算和支付关税,以确保货物顺利通关。通过本文,读者可以了解海关关税支付的基本流程,包括相关手续和注意事项,以便更好地处理进出口贸易中的相关问题。

In the realm of international trade, payment of customs duty plays a pivotal role. It is a necessary evil in order to ensure fair trade practices and revenue generation for countries. Understanding the process of paying customs duty and navigating it effectively can help businesses avoid delays and ensure smooth operations.

What is Customs Duty?

Customs duty, also known as tariff, is a tax imposed on goods imported into a country. It is a form of revenue for the government and is set based on various factors such as the type of goods, their value, and the country they are imported from.

Why is it Important?

Payment of customs duty is crucial for several reasons. Firstly, it helps generate revenue for the government, which can be used for various developmental activities. Secondly, it ensures fair trade practices by creating a level playing field for domestic and international businesses. Thirdly, it helps control the flow of goods and prevents smuggling and other illegal activities.

Process of Paying Customs Duty

1、Determination of Duty: Before making the payment, businesses need to determine the customs duty applicable on the goods they import. This can be done by referring to the customs tariff schedule provided by the government or by consulting customs brokers who are experts in this field.

2、Calculation of Duty: Once the applicable duty rate is determined, businesses need to calculate the duty amount based on the value of the goods and other relevant factors.

3、Payment Methods: There are several methods of payment for customs duty. Businesses can pay online through electronic payment gateways or offline at designated branches of banks or at the customs office. The method of payment may vary from country to country.

4、Documentation: Businesses need to submit necessary documents such as invoices, shipping bills, and other relevant papers to calculate and pay customs duty. These documents should be submitted before the goods are cleared by customs.

Navigating the Process

1、Seek Expert Advice: It is always advisable to consult customs brokers or experts who have extensive knowledge about customs regulations and procedures. They can guide businesses on how to calculate duty, submit documents, and ensure smooth clearance of goods.

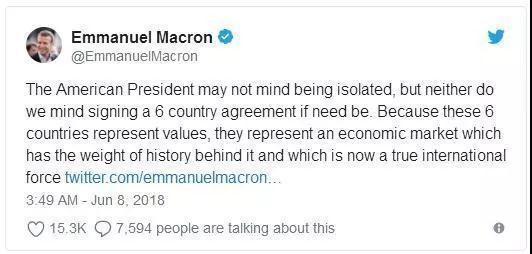

2、Stay Updated: Customs regulations and procedures are subject to change frequently. Businesses should stay updated about changes in customs duty rates and procedures to avoid any delays in importing goods.

3、Use Technology: Using technology like customs clearance software can help businesses calculate duty, submit documents, and make payments quickly and efficiently.

4、Plan Ahead: Planning ahead can help businesses avoid last-minute rush and ensure smooth import of goods. They should calculate duty in advance and make payments on time to avoid any delays at the customs office.

In conclusion, payment of customs duty is an integral part of international trade. Understanding the process and navigating it effectively can help businesses avoid delays, ensure smooth operations, and comply with trade regulations. Seeking expert advice, staying updated, using technology, and planning ahead are some ways to navigate the process effectively.